Discover USDT Risk Checker: Safeguard Your Crypto Transactions

Welcome to the world of secure cryptocurrency handling with the USDT Risk Checker bot! Available on Telegram at @usdt_risk_bot, this powerful tool is designed specifically for checking USDT on the TRC20 network. It performs quick and reliable Anti-Money Laundering (AML) risk assessments on wallet addresses and transactions, helping you identify potential risks before they become problems.

Whether you're a seasoned trader, a crypto enthusiast, or a business dealing with digital assets, the USDT Risk Checker bot empowers you to verify the cleanliness of your funds. By scanning for connections to scams, hacks, blacklisted entities, and other suspicious activities, it ensures you're not unwittingly involved in illicit flows.

Why Are Crypto AML Checks So Important?

In the fast-paced and often anonymous realm of cryptocurrencies, Anti-Money Laundering (AML) checks are not just a regulatory requirement—they're a vital shield against financial crimes and personal risks. AML encompasses a framework of laws, regulations, and best practices aimed at detecting and preventing the integration of illegally obtained funds into the legitimate financial system.

Cryptocurrencies like USDT (Tether) on networks such as TRC20 offer incredible convenience and speed, but their pseudonymous nature can attract bad actors. Without proper checks, users might receive "tainted" funds that could lead to account freezes, legal troubles, or loss of assets. Here's a deeper dive into why AML checks, like those provided by our bot, are essential:

- Combating Money Laundering and Terrorism Financing: Criminals often use crypto to launder money from activities like drug trafficking or ransomware. AML checks trace transaction histories to flag links to known illicit sources, helping to disrupt these networks and protect the global economy.

- Shielding Users from Scams and Fraud: The crypto space is rife with Ponzi schemes, phishing attacks, and exchange hacks. By analyzing wallet addresses, AML tools detect if funds originate from fraudulent activities, saving users from accepting compromised assets that could be seized or devalued.

- Achieving Regulatory Compliance: Governments worldwide, including the US with the Bank Secrecy Act (BSA) and FinCEN guidelines, mandate AML protocols for crypto entities. In the EU, the 5th and 6th Anti-Money Laundering Directives extend to virtual assets. Failing to comply can result in severe penalties, including fines up to millions of dollars or operational bans.

- Fostering Trust and Adoption in the Crypto Ecosystem: As institutional investors and mainstream users enter the market, robust AML measures build confidence. They bridge the gap between decentralized finance (DeFi) and traditional banking, paving the way for innovations like stablecoin integrations and cross-border payments.

- Minimizing Business and Personal Risks: For exchanges, wallets, and merchants, handling dirty money can lead to reputational harm, lawsuits, or asset forfeiture. On a personal level, AML checks help individuals avoid tax issues or investigations by ensuring transparent transactions.

- Enhancing Overall Security: Beyond laundering, AML tools often incorporate Know Your Customer (KYC) elements and risk scoring, which can reveal patterns of suspicious behavior, such as unusual transaction volumes or connections to sanctioned countries.

- Detecting Sanctions and Politically Exposed Persons (PEPs): AML checks can identify links to sanctioned entities or high-risk individuals, preventing inadvertent violations of international laws like those from OFAC in the US.

- Supporting Real-Time Decision Making: In volatile crypto markets, instant AML reports allow users to make informed decisions quickly, avoiding potential losses from tainted funds.

- Promoting Ethical Crypto Practices: By encouraging clean transactions, AML tools contribute to a healthier ecosystem, reducing the stigma associated with cryptocurrencies and aiding mainstream adoption.

- Integrating with Broader Risk Management: AML is part of a larger strategy that includes cybersecurity measures, helping users protect against a wide array of threats in the digital asset space.

In an era where crypto transactions can happen in seconds across borders, staying ahead with AML is crucial. The USDT Risk Checker bot makes this easy and accessible right from your Telegram app, providing instant reports to keep your portfolio safe and compliant.

How the USDT Risk Checker Bot Works

Using the USDT Risk Checker is straightforward and user-friendly. Here's a step-by-step guide to get you started:

- Launch the Bot: Open Telegram and search for @usdt_risk_bot or click the launch button below to start.

- Enter Wallet Address or Transaction: Provide the USDT TRC20 wallet address or transaction hash you want to check.

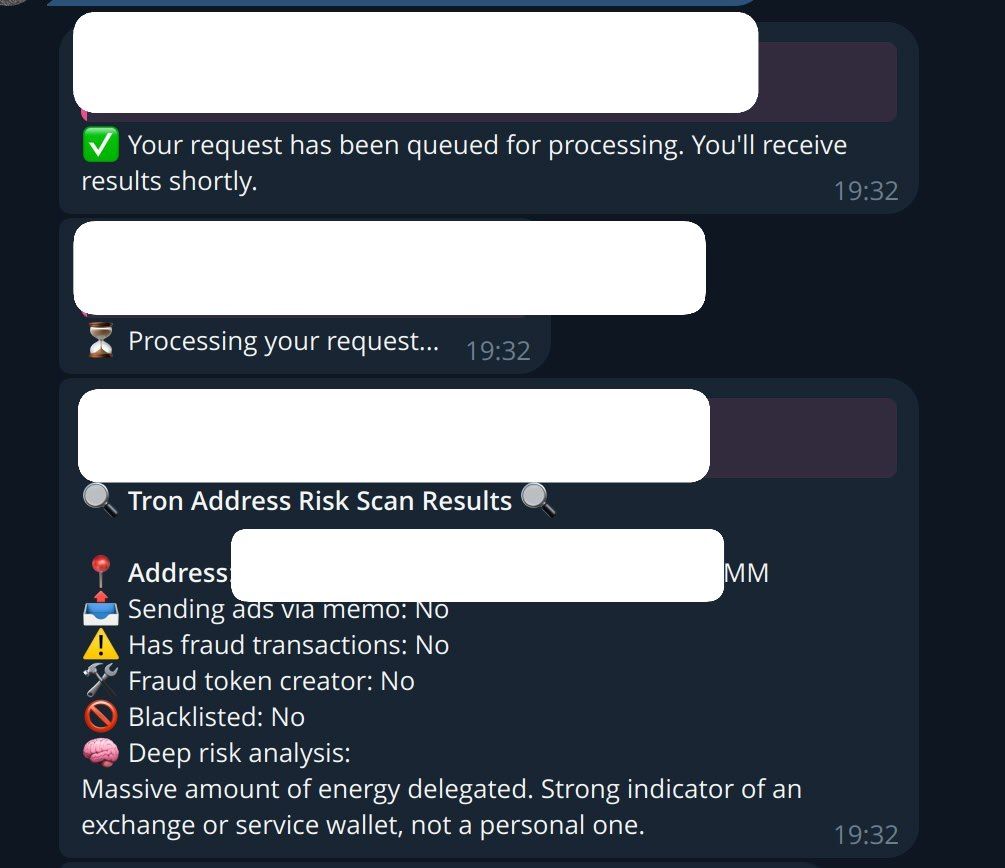

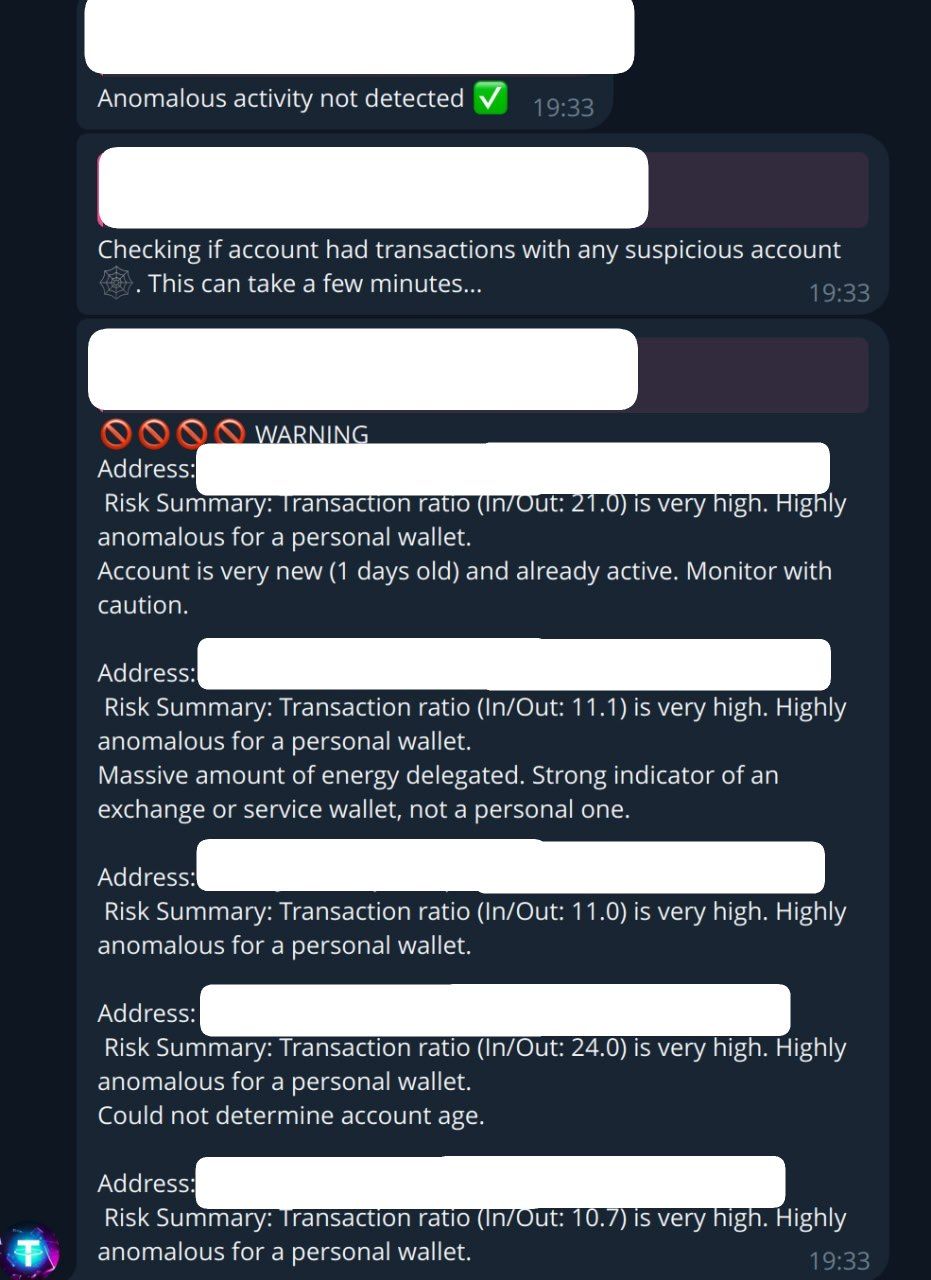

- Receive Instant Report: The bot analyzes the data for AML risks, including connections to scams, hacks, blacklists, and more.

- Review Results: Get a detailed risk assessment with scores and explanations to understand any potential issues.

- Take Action: Based on the report, decide whether to proceed with the transaction or seek further verification.

Below are screenshots demonstrating the bot in action:

Frequently Asked Questions (FAQ)

What is USDT on TRC20?

USDT is a stablecoin pegged to the US dollar, and TRC20 is the token standard on the TRON blockchain, known for low fees and fast transactions.

Is the USDT Risk Checker free?

Yes, it has free tries but you can check more addresses with paid version

How accurate are the AML checks?

Our bot uses up-to-date databases and advanced algorithms to provide reliable risk assessments, though users should always conduct due diligence.

Can I use it for other cryptocurrencies?

Currently, it's optimized for USDT on TRC20, but future updates may include more networks and assets.

What if I encounter an issue?

Contact bot admin that is mention in description for assistance.

Ready to protect your assets? Launch the bot now and experience peace of mind in your crypto dealings.